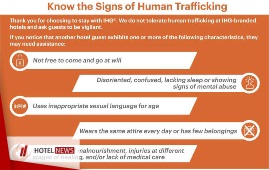

January is recognized as National Slavery and Human Trafficking Prevention Month in the US and IHG® has intensified its ongoing effort to fight human trafficking. The company has introduced new programs, tools and resources for colleagues to increase awareness and aid prevention of human trafficking, including a free training available to all IHG-branded hotels worldwide, including more than 4,200 properties in the Americas. Human trafficking, a form of modern slavery, is a $150 billion criminal enterprise that brings suffering and injustice to an estimated 40 million men, women and children across the globe, according to the International Labor Organization. It is a domestic and international issue that is present in communities of all sizes with individuals of all ages and backgrounds trafficked and exploited for purposes including sexual abuse and forced labor. Elie Maalouf, Chief Executive Officer, Americas, IHG, said: “At IHG, we condemn human trafficking in all forms, and we are taking a strong stance in partnership with our owners, elected officials and others in the industry. We are committed to protecting our guests, communities and owners from the impact of human trafficking as well as maintaining the integrity of IHG’s brands. We will not tolerate it, or those who would enable it, in the IHG system of hotels, and we are empowering all of our colleagues with the tools, resources and support they need to combat this crime on every level.” Most recently, in December, IHG hosted dozens of colleagues from local Georgia hotels for a group training and discussion at the Crowne Plaza® Atlanta Perimeter at Ravinia, located near the company’s Americas headquarters in Atlanta. During the event, attendees learned about the work to fight human trafficking in Georgia from First Lady Marty Kemp, as well as support and assistance programs available for survivors from Mary Frances Bowley, founder and executive director of non-profit Wellspring Living. “Our partnership with the hotel and lodging industry is forged by a common goal: ending human trafficking in Georgia,” said First Lady Kemp. “I applaud IHG’s efforts to train employees on identifying the warning signs of trafficking and supporting survivors. Education and awareness are key in this critical fight, and this training equips staff with the potential to save lives.” IHG has released a new video featuring a one-on-one conversation with First Lady Kemp and Colleen Keating, Chief Operating Officer, Americas, IHG, where the two leaders discuss the importance of public-private partnership in the fight against human trafficking and progress in the state of Georgia. Since its launch in summer 2019, colleagues in more than 2,300 hotels across the U.S., Canada, Latin America and the Caribbean have completed IHG’s online anti-human trafficking training. The company expects colleagues in all IHG-branded hotels in the region to have completed the training by March 2020. Additionally, IHG continues to work closely with a variety of organizations such as the American Hotel & Lodging Association (AHLA), Asian American Hotel Owners Association (AAHOA) and Georgia Hotel & Lodging Association (GHLA) to share best practices, coordinate efforts and attack the issue on all levels. The company has also engaged in additional collaborative efforts, such as commitments to ECPAT and the criteria of The Code, as well as the AHLA 5-Star Promise. IHG also actively supports non-profit organizations that provide essential goods and services to support the recovery of human trafficking survivors, and coordinates regular volunteer opportunities for colleagues. IHG is a global company with a presence in more than 100 countries. The company considers addressing human trafficking a key component of its larger commitment to responsible business and at the core of how it operates. Read more about the company’s position and its consistent standard across every market in its global Human Rights Policy.

Create: Jan 11, 2020 Edit: Jan 11, 2020 International News

The South East Asia (Indonesia, Malaysia, Myanmar, Philippines, Singapore, and Vietnam) lodging industry experienced mixed sentiments for 2019. Despite growth in tourism arrivals, the ever-changing political climate, mercurial global economic conditions, and growth in accommodation supply are few of the many reasons that continue to put downward pressure on several markets. Even with the headwinds, the underlying dynamics behind demand growth appear to be resilient and are expected as such going forward. The global economic growth is anticipated to end off at a rate of 3.0% in 2019, before gradually recovering back to the 2018 performance of 3.6% in 2021. Nonetheless, South East Asia remains the fastest-growing region in the world and is projected to grow at a rate of 5% in 2019. While the global Consumer Price Index (CPI) forecast remains relatively stable, South East Asia’s CPI has been projected to abate from 3.4% in 2018 to 2.8% in 2019, mainly held back by slow wage growth and prolonged trade tensions. However, South East Asia’s unemployment rate remains at a low 3.5% and is expected to prevail at the same level through 2021. The region’s inflation is anticipated to rise in 2021 on the back of looser monetary conditions and resilient domestic demand. As of year-to-date (YTD) Q3 2019, South East Asia registered a growth rate of 12.3% in international visitor arrivals, a 2.1% increase from the same time last year. While Malaysia recorded year-over-year (YOY) growth of 3.7% as of YTD September 2019, a five-year compound annual growth rate (CAGR) of 0.1% reveals that the country continues to miss tourism goals and struggles to attract more tourists. The South East Asia (Indonesia, Malaysia, Myanmar, Philippines, Singapore, and Vietnam) lodging industry experienced mixed sentiments for 2019. Despite growth in tourism arrivals, the ever-changing political climate, mercurial global economic conditions, and growth in accommodation supply are few of the many reasons that continue to put downward pressure on several markets. Even with the headwinds, the underlying dynamics behind demand growth appear to be resilient and are expected as such going forward. The global economic growth is anticipated to end off at a rate of 3.0% in 2019, before gradually recovering back to the 2018 performance of 3.6% in 2021. Nonetheless, South East Asia remains the fastest-growing region in the world and is projected to grow at a rate of 5% in 2019. While the global Consumer Price Index (CPI) forecast remains relatively stable, South East Asia’s CPI has been projected to abate from 3.4% in 2018 to 2.8% in 2019, mainly held back by slow wage growth and prolonged trade tensions. However, South East Asia’s unemployment rate remains at a low 3.5% and is expected to prevail at the same level through 2021. The region’s inflation is anticipated to rise in 2021 on the back of looser monetary conditions and resilient domestic demand. As of year-to-date (YTD) Q3 2019, South East Asia registered a growth rate of 12.3% in international visitor arrivals, a 2.1% increase from the same time last year. While Malaysia recorded year-over-year (YOY) growth of 3.7% as of YTD September 2019, a five-year compound annual growth rate (CAGR) of 0.1% reveals that the country continues to miss tourism goals and struggles to attract more tourists. Vietnam achieved the highest CAGR of 15.4%, followed by Indonesia (12.4%) and Myanmar (9.2%). The strong tourism demand has been driven by an increase in flight connectivity and concerted tourism efforts by the government, such as easing of visa restrictions, developing infrastructures, supporting tourism enterprises, and the promotion of tourism campaigns. Looking forward, the Indonesian government has actively promoted its "10 New Balis" program, established in 2018, to develop and promote several destinations beyond Bali, including Mandalika in West Nusa Tenggara, Thousand Islands in Jakarta, Tanjung Lesung in Banten, Tanjung Kelayang in Bangka Belitung, Borobudur Temple in Central Java, the Bromo Tengger Semeru National Park in East Java, Labuan Bajo in East Nusa Tenggara, Wakatobi in Southeast Sulawesi, and Morotai in North Maluku. In conjunction with Visit Malaysia 2020 (VM2020), Tourism Malaysia has recently launched a digital initiative, the VM2020 Website Campaign, which aims to entice and showcase various destinations in the country to more tourists. In early 2019, the Myanmar government launched the Myanma Tourism Bank to spur development in its growing tourism sector by offering low interest loans to tourism enterprises. In the Philippine government’s National Tourism Development Plan, the country seeks to spur growth and development through foreign direct investment by showcasing attractive areas in the Tourism Enterprise Zones. Singapore has also announced mega projects to fuel long-term tourism including the Greater Southern Waterfront development, Mandai eco-tourism hub, Jurong Lake District’s seven-hectare tourism development, and the expansion of the two integrated resorts. Apart from an effort to further develop less well-known tourist sites and diversify tourism products, Vietnam will soon launch a new tourism marketing campaign, #VietnamNOW, to build awareness of the country’s tourism assets andevents. Vietnam achieved the highest CAGR of 15.4%, followed by Indonesia (12.4%) and Myanmar (9.2%). The strong tourism demand has been driven by an increase in flight connectivity and concerted tourism efforts by the government, such as easing of visa restrictions, developing infrastructures, supporting tourism enterprises, and the promotion of tourism campaigns.

Create: Jan 6, 2020 Edit: Jan 6, 2020 International News

JW Marriott, part of Marriott International, Inc., today announced the opening of JW Marriott Sanya Haitang Bay, located on the Haitang Bay, the National Coast of China. The property marks JW Marriott’s second resort on Hainan and eighteenth hotel in Greater China, seamlessly blending in with the lush landscape of Haitang Bay and illustrating the beguiling charm of the entire coast. Adjacent to Yalong Bay National Tourism Resort, Haitang Bay boasts stunning scenery including tropical forests, white sandy beaches and shimmering waters. A 40-minute drive from Sanya Phoenix International Airport, the area is home to numerous tourist attractions including Wuzhizhou Island, Sanya Haichang Fantasy Town, Nanshan Temple and the Wanda International Cinema, among others. The new JW Marriott Sanya Haitang Bay is located on a 21.8-kilometer-long shoreline, providing a luxury escape for travelers who come to feel present in mind, nourished in body and revitalized through the brand’s curated programming. “We are truly delighted to continue to expand our brand portfolio in Sanya, China.” said Mitzi Gaskins, Vice President & Global Brand Leader, JW Marriott. “JW Marriott Sanya Haitang Bay is bringing a modern, luxurious setting to our guests in Sanya, as well as encouraging them to embrace the present and savor life to the fullest in a mindful and nourishing environment.” Inspired by the theme of ‘stone’, the subtle design by Smallwood, Reynolds, Stewart, Stewart (SRSS) connects guests at JW Marriott Sanya Haitang Bay with nature through endless arcades, ceramic accents, an octagonal fountain and peacock pavilion that reflect the hotel’s luscious backdrop. The property’s 142 guestrooms and 18 villas, ranging from 735 sq. ft. to 7,180 sq. ft., feature private balconies and combine modern designs with genuine aesthetics to create the optimum sense of relaxation. Two exquisite dining facilities ensure the ultimate epicurean experience for travelers. Guests can enjoy live cooking presentations in JW Kitchen’s all-day open-kitchen restaurant or relax in the tropical ambiance of the JW Lounge, featuring signature cocktails and wines from around the world. Additionally, JW Marriott Sanya Haitang Bay highlights its commitment to naturally-inspired dining through its JW Garden to offer fresh, local ingredients for authentic farm-to-table dining experiences, hands on cooking classes and specialty drinks. JW Marriott Sanya Haitang Bay is the perfect venue for hosting romantic weddings, corporate meetings and special events with over 37,600 sq. ft. of meeting space, 86,000 sq. ft. of outdoor lawn, flexible seating solutions and comprehensive business facilities. Guests can rejuvenate at the fully-equipped Health Club featuring over nine different-sized pools, or enjoy pampering at the luxurious Spa by JW. “The increase and transformation of the tourism market within China and specifically Hainan is significant, with the island now housing 23 hotels, covering different lifestyle needs,” said Henry Lee, President, Greater China, Marriott International. “The expansion of the JW Marriott brand in Sanya allows us to add unique offerings and enriching, thoughtfully-curated experiences for guests, leaving them with unforgettable memories.”

Create: Jan 4, 2020 Edit: Jan 4, 2020 International News

Key trends - Technology advances to simplify travel; more conscious eco travel choices; Kyoto tops destination wishlist. Single apps for all travel needs, passport free travel, and mobile app check-in are the top three ‘new travel norms’ expected by travelers in the next decade, according to new research by Agoda. With the continued advancement of technology, revolutionary travel apps, and better connectivity, people expect a lot more from their travel experience in the next decade. Specifically, Southeast Asians half of all respondents in Indonesia (56%), Singapore (54%), Malaysia (53%), Taiwan (50%), the Philippines (48%) and Thailand (48%) considering this the norm in the next decade. This compares to only a third of people in the United Kingdom and the United States (33%). Specifically, in Taiwan (50%) and in Southeast Asia half of all respondents in Indonesia (56%), Singapore (54%), Malaysia (53%), the Philippines (48%) and Thailand (48%) considering this the norm in the next decade. This compares to only a third of people in the United Kingdom and the United States (33%). Meanwhile, Singapore (50%), Vietnam (47%), Philippines (45%), China (44%) and Australia (41%) are the top five origins most likely to see a future with passport-free travel. In the UK and US, they are less expectant of this advancement with only 1 in 5 expecting it to be the norm within the next decade. Technology has already made such a positive impact on how and where people travel as innovative technologies, like those developed at Agoda, give travelers instant access to millions of hotels and home properties around the world with real time pricing and availability. “It is a technology golden age for travelers, as technology is developed to simplify the way anyone, anywhere can search, book and pay for flights, hotels or holiday accommodation. The 2000s was defined by the mouse and the computer, putting online travel booking just a click away. The 2010s, was defined by the smart phone and app, and put a travel agent in the pocket of every phone owner, and the 2020s will be defined by the power of data and Machine Learning (AI). This will enable companies like Agoda to provide personalized, more relevant recommendations to make booking travel even easier,” explains Timothy Hughes, Vice President of Corporate Development at Agoda. "Asian travelers, in particular, are enthused by, and expectant of, technology developments that enhance and simplify their travel experience. Asian based companies are now leading the world in technology adoption and development to achieve this. I expect to see Asia press ahead with that lead in the 2020s - especially in areas such as video and augmented reality, improved mobile services with more chat and voice solutions, and payments to help bring the "unbanked" online". Globally, people want to increase travel, but also to make eco-friendlier travel choices Universally, people want to increase the amount of travel they undertake in the 2020s. Exploring more of their own country is cited by 40% of respondents globally, while international travel more often is anticipated at 35%. What’s also interesting, in the context of global narratives on climate sustainability, is the trend that more than a quarter want to make more eco-friendly travel choices in the next decade. Travelers from Singapore, Thailand and Indonesia are most keen to make eco-friendlier choices perhaps more aware than others with the recent closure of Maya Bay in Thailand, and the Boracay rehabilitation program in Philippines, and thus travelers want to do their bit even when on holiday. Travelers in the 35-44 and 55+ age groups are most likely to want to explore their own countries and territories more (40% and 42% respectively), with those from China, Indonesia, Japan, Malaysia, The Philippines, Taiwan, Thailand, US and Vietnam choosing domestic destinations within their top three wishlist destinations for the coming decade. Meanwhile Korean and Japanese travelers see themselves taking more solo trips in the next decade. Taiwanese and Indonesians would prefer taking a sabbatical or gap year. Kyoto scoops #1 spot as the world’s most desired destination to visit in the 20s Asia dominates the global travel wishlists destinations for the next decade, as travelers from both Asia and the West showcase a growing curiosity for Asian treasures like Kyoto (Japan) famed for its Shinto shrine, Kyoto is an eclectic blend of culture, food and history, followed by Bangkok, (Thailand) and Bali, (Indonesia). Travelers in Philippines, Thailand, Taiwan, Vietnam and Malaysia want to cross off their own capital cities from their travel lists. Meanwhile, South Korea, the UK, and Australian travelers are the only one who don’t choose a domestic destination on their wishlists for travel in the next decade. American and British travelers alike are most excited about visiting New York in the coming decade, with New York also a top three choice for travelers from Australia, Japan and South Korea. Both Malaysian and Indonesian travelers would like to visit Makkah by 2030. USA Next Decade of Travel 42% of Americans expect to check into hotels using their mobile phones as the norm while 29% expect to use a single app for all their travel needs. 12% of Americans want to make more eco-friendlier choices when traveling in the next decade. New York tops wishlist travelers in the US in the 2020s. This is followed by London (#2) and Sydney (#3). 38% of Americans would like to explore more of their own country in the next decade, while 26% would like to travel more internationally About the travel data All figures, unless otherwise stated, are from YouGov Singapore PTE Limited. Total sample size was 16,383 adults. Fieldwork was undertaken between 12 December 2019 and 18 December 2019. The survey was carried out online. The figures have been weighted and are representative of adults in the respective countries (aged 18+). Additional country breakdown can be found in the Agoda Press Room. About Agoda Agoda is one of the world’s fastest growing online travel booking platforms. From its beginnings as an e-commerce start-up based in Singapore in 2005, Agoda has grown to offer a global network of over 2.5 million properties in more than 200 countries and territories worldwide, offering travelers easy access to a wide choice of luxury and budget hotels, apartments, homes and villas to suit all budgets and travel occasions. Headquartered in Singapore, Agoda is part of Booking Holdings (Nasdaq: BKNG) and employs more than 5,000 staff across 67 cities in more than 30 countries. Agoda.com and the Agoda mobile app are available in 38 languages.

Create: Dec 30, 2019 Edit: Dec 30, 2019 International News

Two consecutive months of profit growth gave way to a contraction in November for hotels in the Middle East & North Africa as GOPPAR declined year-over-year. The region had a nice, albeit short, run of GOPPAR gains prior to November’s downtick, but the drop is more in line with MENA’s overall dim 2019 performance. If there is a silver lining, the 1.7% drop is the smallest YOY decrease of the year and far smaller than the YTD number of -4.2%. Rooms revenue was down 2.6% compared to the same month last year, dragged down by a 5.1% drop in room rate. Occupancy for the month was up 1.9 percentage points to 76.2%. The drop in rooms RevPAR, along with a 1.5% YOY decrease in F&B RevPAR, equated into an overall decrease in total revenue of 2.7% YOY. And while generating revenue in November proved onerous, expense control was a bright spot. Total overhead costs on a per-available-room basis were down 3.4% YOY and total labour costs were also down—2.4% YOY. Utility expenses came down 3.0%, while overall Property & Maintenance costs were down 2.6%. In contrast to the totality of MENA, Egypt pushed out a positive month of profit, with a 2.9% overall YOY jump. This came on the back of a 1.3% rise in RevPAR and a 3.6% rise in TRevPAR. The resort town of Sharm el-Sheikh saw a huge GOPPAR leap of 65.1% YOY, bolstered by a 28.6% jump in RevPAR. The fortunes of Sharm el-Sheikh hotels have turned for the better after having dealt with its share of terrorist attacks, including in 2005 and, in 2015, when a Russian jetliner departed the city and subsequently exploded over Sinai killing 224 people onboard. Thereafter, the UK grounded flights to the beach getaway, and weekly arrivals fell from 10,000 to zero. In December, flights resumed from the UK, which should put a further jolt into the resort town’s tourism economy. Meanwhile, Egypt’s capital, Cairo, did not share the same fortune, checking in with a 1.5% decrease in GOPPAR YOY. RevPAR was down 3.4% YOY, a result of both a drop in rate (down 1.9%) and occupancy (down 1.2 percentage points). TRevPAR for the month was up 0.8% due to a 9.2% YOY increase in F&B RevPAR. It was another down month for Dubai, which saw its profit drop 9.6% YOY. The emirate has only had one month of YOY GOPPAR growth in the last 15, plagued by excessive and unabated hotel supply and development. Coming months and years will require hoteliers to be more cost-conscious than revenue-conscious, according to many experts. RevPAR in Dubai was down 9.3% YOY in November, as room rate dropped 8.6% YOY combined with a -0.7% percentage-point decline in occupancy. Total overhead costs declined in the month, down 6.2% YOY, but not enough to produce positive profit growth, evidenced by a 0.4 percentage-point decline in profit margin.

Create: Dec 30, 2019 Edit: Dec 30, 2019 International News

International visitor spending more important to cities than it is to countries, nine out of 10 top fastest growing cities in past decade are in emerging and developing countries and cities over reliant on domestic or international demand are more exposed to economic and geopolitical risks. The World Travel & Tourism Council (WTTC), which represents the global Travel & Tourism private sector, today released its comprehensive Cities Report for 2019. The report focuses on 73 major tourism city destinations, providing estimates of the GDP and employment directly generated by the Travel & Tourism sector, and highlights successful initiatives, strategies and policies that have been implemented. With more than half (55%) of the world’s population living in urban areas – due to increase to 68% over the next 30 years – cities have become the hubs for global economic growth and innovation, while also attracting more people who want to live and do business. The report reveals these 73 cities account for $691 billion in direct Travel & Tourism GDP, which represents 25% of the sector’s direct global GDP and directly accounts for over 17 million jobs. Additionally, in 2018, direct Travel & Tourism GDP across the cities, grew by 3.6%, above the overall city economy growth of 3.0%. The top 10 largest cities for direct Travel & Tourism contribution in 2018 offer diverse geographic representation, with cities such Shanghai, Paris, and Orlando all sitting in the top five. International visitor spending is often more important to cities than it is to countries overall. For example, Riyadh had international visitor spending accounting for 86% of total spending, while in Saudi Arabia as a whole, international visitor spending accounts for 45% of total spending. International visitors accounted for almost half (45%) of tourism spending across the 73 cities in the study, and an average spend of 29% for economies worldwide. Revenues from international visitors, will in some cases pay for city infrastructure projects, the provision of public workers and services that improve the quality of life for residents. For example, in London, international visitors spent $17.5 billion in 2018, nearly twice as much as the operating costs of Transport for London, and near four times the amount than the total expenditure for policing and crime within the city. Furthermore, international visitors in New York spent $21 billion last year, which is 3.8 times higher than the costs of the NYPD, and nearly twice the budget for city schools. The report also reveals all but one of the 10 global cities with the highest direct Travel & Tourism growth over the past decade, are in emerging and developing economies such as China, Turkey and the Philippines. Infrastructure development and prioritisation of tourism, has been a key driver of Travel & Tourism growth. The projected trends for 2018-2028 continue in this way, with all 10 coming from emerging and developing countries such as Morocco, India, Vietnam and Indonesia. According to the report, cities with an overreliance on domestic or international demand are more exposed to economic and geopolitical shocks. Some large Brazilian and Chinese cities which are highly reliant on domestic demand, could be exposed to changes in the domestic economy. On the other hand, cities which are more reliant on international demand and/or particular source markets, may be vulnerable to external disruptions. It also highlights several cities which demonstrate a more balanced split between domestic and international demand, including Cancún, Munich, Cairo and New York, which despite their geographical differences, all maintain a near perfect 50:50 split. Furthermore, a high degree of seasonality can also, at times put pressure on infrastructure, due to the heightened demand during a narrow timeframe. WTTC President & CEO, Gloria Guevara said: “Cities are an essential part of the Travel & Tourism sector, both culturally and economically, and their significance is set to increase over time. Achieving sustainable growth in cities requires reaching far beyond the sector itself, and into the broader urban agenda. As we go forward, the Travel & Tourism sector must be integrated into all aspects of a cities’ planning agenda. To drive true economic impact that can translate seamlessly into social benefits, a city must engage with all stakeholders, across the public and private sector, in order to establish the cities of the future. There is an opportunity to create long-term, sustainable change that can create real change for communities, especially within cities.” Read the WTTC City Travel & Tourism Impact Report 2019 here.

Create: Dec 24, 2019 Edit: Dec 24, 2019 International News

Hoteliers are always looking for ways to improve their digital strategies and turn every dollar into an even greater revenue-driving initiative. Every hotelier’s marketing mix should include metasearch — especially considering all of the new and exciting updates coming to existing metasearch platforms and search engines. Google and TripAdvisor are rolling out new optimization and targeting options that will allow advertisers to reach relevant audiences and maximize spend. Also, Bing is introducing Bing Hotel Ads, and NextGuest is one of the first agencies to offer connectivity and presence on this important search engine. Download the whitepaper to uncover metasearch fundamentals and learn about all of the new updates of today’s metasearch.NextGuest Digital uses the latest in digital marketing technology to assist hotel brands in crafting their digital presence. Through the agency’s smartCMS®, Content Personalization Engine, Smart Data Marketing, and other innovative initiatives, hoteliers see a drastic boost in direct bookings, as well as lower distribution costs and an increase the lifetime value of guests. NextGuest Digital is part of NextGuest, an all-encompassing partner that helps hoteliers acquire, engage, and retain their next guest. Based in New York City, the company is comprised of NextGuest Digital, CRM, Labs, and Consulting.

Create: Dec 16, 2019 Edit: Dec 16, 2019 International News

Lord Nelson Hotel & Suites is an independently owned 262-room historic property with 12,500 square feet of meeting space in Halifax, Nova Scotia. In 2018 it completed a full renovation of its guestrooms, meeting space and common areas. The property benefited from a large increase in area tourism with new market segments and international guests. These factors made it clear to management that Lord Nelson’s legacy property management system (PMS) did not provide the functionality the hotel required and triggered its search for new hotel software. Lord Nelson Hotel & Suites is a locally owned historic independent that wanted to keep its historic heritage but move property operations into the 21st Century. “We took time to make the right decision,” said Kathryn Buttle, Lord Nelson’s Assistant General Manager- Revenue. “We wanted a cloud-based PMS that supported the specific hotel software modules we needed on one platform. Maestro’s suite of fully-integrated modules on a single-image database was ideal for the unique way we do business.” Lord Nelson Hotel & Suites installed Maestro’s Front Desk, Sales and Catering, ResWave Online Direct Booking engine, Mobile Housekeeping, SMS Messaging for guest and staff communications, Digital Registration for remote check-in, Travel Agency accounting, and Yield Management to optimize rates and occupancy all on the Maestro Web cloud-based system. They also recently added the integrated Online Payment Portal and are considering expanding to Maestro’s Loyalty Module and Business Analytics. “We recently discovered an unexpected benefit with Maestro,” Buttle said. “The property was hit with a power failure during a storm. When the power went out, the Maestro Web cloud-based system enabled us to continue operation using our tablets and mobiles. We ran our hotel on iPads. Maestro’s Mobile Housekeeping module even kept our housekeepers doing their job with tablets.” System selection guidelines for independent operators “I recommend that independent operators take time to list all the factors they need to make the right decision. They should bring their teams together to understand how each department does business,” Buttle said. “We began by listing the modules we wanted and reviewed each department’s processes. Our evaluation list included six PMS companies. We had numerous calls with each company and arranged multiple demonstrations over a six-month period. I worked with our IT manager to balance our property’s needs with what each system offered.” The property told vendors the issues it had with its current system, and explained what functionality was non-negotiable. “We created a firm baseline for functionality we had to have. We asked each company specific questions about processes and interfaces. We described our tasks and asked how their system handled them. We focused on the most important modules to our operation. For example, we are a 40-percent group property, so an integrated, full-function Sales and Catering system was essential.” Maestro PMS was the best system for Lord Nelson Hotel & Suites “Since we are an independent property, professional training and support were principal factors in our decision process,” Buttle said. “In addition, we wanted a cloud-based system to simplify our infrastructure requirements. Based on our functionality requirements and system evaluation we selected the Maestro PMS suite of modules on the Maestro Web cloud platform. It has been a good decision for our operation.” Maestro’s Sales and Catering System also proved itself to Lord Nelson’s operation. “We use an outside caterer,” Buttle said. “Maestro’s Sales and Catering system is flexible enough to let our third-party vendors update their event covers, menus, and billing details to keep our operation running smoothly. Our system installation and training went very well and Maestro’s support is excellent. Maestro online Live Chat Support lets our staff get answers to system use questions in real-time to be more productive. Plus, if we request an enhancement, Maestro evaluates our request and tells us when they can deploy it at our property.” The Maestro Property Management System is the preferred hotel software for independent hotels, resorts, conference centers and multi-property groups. It delivers flexible and scalable deployment options with an identical full-featured web browser or windows solution available in the cloud or on premise. Click here for more information on how to engage and socialize with Maestro PMS.

Create: Dec 11, 2019 Edit: Dec 11, 2019 International News

South Korean operator KT has launched its AI-enabled hotel service robot in Seoul. The AI hotel robot, dubbed ‘N bot’, started its official service at Novotel Ambassador Seoul Dongdaemun Hotels & Residences, to serve guests in 100 rooms, Yonhap news agency reports, citing a company statement. KT used 3D location mapping, autonomous driving and AI camera capabilities to develop the robot. Guests can request items through voice command or touch screen of KT's GiGa Genie device in a room, and N bot will identify the location to deliver the items, SK said. With help of its autonomous driving technology, the robot can take an elevator to move from one floor to another and stop or pass by oncoming people to avoid collisions. Back in February, KT opened a robot cafe in the main venue of MWC Barcelona to serve free coffee to visitors. The barista robot served 47 kinds of drinks at the GSMA Innovation City exhibition hall. In October this year, KT announced it will start selling its hotel service offering artificial intelligence-based features to hotels in the Philippines. The service will be gradually expanded to hotels in Singapore, Dubai and Guam. KT recently announced plans to invest KRW 300 billion (approximately USD 256.9 million) in the next four years to develop advanced AI-based services. KT will develop AI technology in the areas of language, image, analysis and problem solving, in an attempt to increase the number of AI-enabled devices to 100 million by 2025.

Create: Dec 7, 2019 Edit: Dec 8, 2019 International News

Since launching in 2018 campaigns have delivered increases of an average of up to 30% for over 50 tourism boards globally, each strategic campaign enables Tourism Boards to navigate the highly fragmented landscape of the global travel industry, targeting specific demographics in desired source markets. Hotelbeds has confirmed the successful launch of an industry-first B2B service for destination marketing organizations (DMOs) globally to drive incremental tourism arrivals. Leveraging the company’s technology, booking platform, and relationships with hoteliers and B2B travel buyers globally, Hotelbeds has to date already worked with over 50 tourism boards from around the world. The result has been to increase room nights for target destinations by up to 30% on average – plus improving revenue performance – by attracting additional low- and shoulder-season visitors from international and domestic source markets globally. Partner destinations receive access to the over 60,000 B2B travel trade buyers – such as retail travel agents, tour operators, airlines, and points redemption clients – who together make over 1.5 billion accommodation searches per day via Hotelbeds. Due to the international reach of Hotelbeds – present in over 140 source markets globally, with the fast-growing Chinese market already the fourth biggest globally for the company – destination partners also benefit from receiving more international and long-haul arrivals. Bookings from international and long-haul source markets in turn deliver high-value customers who spend more in destination, stay longer, cancel less, return more often and book farther out than typical direct to consumer customer profiles (which tend to be highly domestic). Gareth Matthews, Director of Marketing & Communications at Hotelbeds, stated: “Our whole purpose as a travel distributor is to drive incremental high-value bookings for hotels from non-competing, hard to reach B2B travel trade sources such as retail travel agents and tour operators. So we thought why not also do the same for destinations? No one else is offering destination marketing boards such a comprehensive set of opportunities that allows them to easily access the distribution power of the world’s travel trade. We launched the service at a global level last year and I´m pleased to confirm that our knowledge, experience and infrastructure is already delivering, on average, increases in incoming visitor paxes of 30% for our destination partners.” Joseph Sheller, Head of Destination Marketing, commented, “I am proud to say that our Hotelbeds Destination Marketing service is in high demand on a global level. We pride ourselves on delivering highly tangible ROI for our partners and measure our success by the incremental year-over-year increase in room nights/PAX produced by the campaigns, as well as the total overall economic impact. What destination doesn´t want incremental visitors that also stay longer and spend more, especially during the low- and shoulder-seasons? As the first B2B travel distributor to launch this service, we are truly revolutionizing the landscape of destination marketing!”

Create: Dec 7, 2019 Edit: Dec 7, 2019 International News

PORTSMOUTH, NH – Analysts at Lodging Econometrics (LE) report that at the end of the third quarter of 2019, China’s total construction pipeline has grown to 3,380 projects/628,972 rooms. Currently, the country has 2,548 projects with 438,797 rooms under construction with projects scheduled to start construction in the next 12 months at 404 projects with 85,026 rooms. Projects in the early planning stage have 428 projects/105,149 rooms. Hotel development continues to thrive despite the continued economic struggles in the region and the on-going trade and tariff disputes with the United States. In the third quarter, China announced 661 new projects with 80,692 rooms into the pipeline. Through the third quarter of 2019, China opened 658 new hotels/92,932 rooms with another 363 new hotels/45,799 rooms forecast to open by year-end. In 2020, 1,084 new hotels with a lofty 157,893 rooms are forecast to open. Should all of these hotels come online in 2020, then China will open the largest number of new hotel rooms since the cyclical peak in 2014. In 2021, following a year of all-time high new hotel openings, LE forecasts that the number of new hotel openings will decelerate to 773 hotels with 135,294 rooms. Chengdu, at a record high 124 projects having 25,560 rooms, leads China’s pipeline. Guangzhou follows standing at 122 projects with 26,105 rooms, then Shanghai at 119 projects/22,581 rooms. Next is Wuhan and Suzhou with 111 projects/15,457 rooms and 88 projects/14,855 rooms, respectively. Also, notable, with strong room counts, are Hangzhou with 73 projects/15,647 rooms and Xi’an with 80 projects/15,054 rooms. Four of the seven cities listed above have pipeline increases in excess of 20% of their existing open and operating supply with Chengdu having a pipeline in excess of 30%. Franchise companies topping China’s construction pipeline are led by Hilton Worldwide with 454 projects/93,644 rooms. Next is InterContinental Hotels Group (IHG) with 375 projects/82,358 rooms and Marriott International with 315 projects/86,151 rooms. All three of these companies are setting record pipeline highs by projects and rooms and account for 34% of China’s total pipeline. Other notable franchise company pipelines are AccorHotels with 218 projects/35,556 rooms and JinJiang Holdings standing at 214 projects/22,548 rooms. Brands in the pipeline are led by Hampton by Hilton with a record 273 projects/42,645 rooms. Hilton’s second largest brand, by project count, is DoubleTree with 59 projects/16,489 rooms. IHG’s primary brands in China are Holiday Inn Express, at a record count, with 179 projects/31,430 rooms and Holiday Inn with a record 61 projects having 15,435 rooms. Marriott International’s top brands are the full-service Marriott Hotel & Resort, hitting record highs, with 73 projects/22,068 rooms and then Courtyard with 39 projects/10,250 rooms. Leading brands for JinJiang Holdings are 7 Days Inn with 113 projects/8,931 rooms, and Vienna Hotel with 26 projects/3,300 rooms. AccorHotels’ leading brand, Ibis, is also hitting all-time highs with 102 projects/10,888 rooms, while Mercure Hotel also has a record number of projects with 58 and totaling 9,346 rooms.

Create: Dec 7, 2019 Edit: Dec 7, 2019 International News

The thinking and analyses of benchmarking continues to dominate hotelier discussion, and the industry’s most nimble minds are not satisfied the terminology, emphasis and focus have reached any type of apex. MANCHESTER, England—Hoteliers are in no doubt benchmarking has been one of the major, if not the most major, catalysts of the last decade helping fuel hotel performance, and the data is only getting better and more involved, according to sources. Now hoteliers are considering how benchmarking might change as the industry reaches what many consider the end of a cycle. Speakers on a panel at the recent Annual Hotel Conference titled “Sitting on the bench or pressing it” indicated one goal is the analyses of rooms benchmarking, not just around the primary sale, but all the way through the profit and loss account. That changes depending on the operating business model, sources said. “At the core is the transparency of data, and doing something with it. It is output rather than the input,” said Jonathan Walker, managing director of the 40-room No. 15 Great Pulteney in Bath, England, and a former director of hotel performance and operations support, Europe, at InterContinental Hotels Group. “It is not cash from benchmarking, but the cash you are missing if you do not have it, and the ability to articulate that to stakeholders,” said Kym Kapadia, chief commercial officer at Aprirose Real Estate Investment, which in 2017 bought from Bain Capital the 26-asset QHotel portfolio for £525 million (at the time equivalent to $706 million). “We’re seeing a shift in relevance of the historic data. It is now about looking ahead, monitoring pick-up and pace and about the business on the books,” said Steven Cote, product manager at Forward STAR, a division of STR, the parent company of Hotel News Now. Nick Turner, managing director at Owners Management Group International, a hotel-management company in the lifestyle and boutique space, said even more importance has to be placed on getting the competitive set right. “Otherwise it is rubbish in and rubbish out. It has to be right on an asset-by-asset basis, and it starts with the right comp set,” Turner said. “No one understands the business better than the GM on the ground, and it takes analysis and experience and talking to people,” he added. Sources said hoteliers now are focused on analyses of revenue-generation indices, comparing individual revenue per available room with that of the comp set and seeing how that metric changes for individual hotels when the market changes. Kapadia said keeping on top of the numbers has changed enormously as the number and range of stakeholders have increased. “It can be subjective in terms of the numbers of layers of ownerships and their opinion, and you have to look at the unemotional numbers,” she said. She said hoteliers still need to understand what they are and where they want to go before they get deep into the arithmetic. “Learn from best in class and overtake them, and remember there always are a cycle and an exit,” Kapadia said. “It is so important to have feasibility on any acquisition and investment. Yes, the forward-looking data is huge for the cycle, business plan and exit. Who knows, but with some insight and rationality, you’ll have a good guess.” Hoteliers who are not part of large portfolios or multi-brand platforms still are being nimble in what data they want and how to get it. “You have to have a vision as to where the product will be pitched,” Walker said. “We do a lot of research on product we might not know. We look at location, style, size, the obvious things, but also a few extra things … the quality side, being aware and curious as to what else is happening in your market.” Unlocking potential Hoteliers need to keep up to date, as third parties certainly are doing so, Walker said. “Last year, we were looking to open a hotel in Bristol, and we had a really awkward two-hour meeting, as (the other party) knew far more than we did. Benchmarking has to be ingrained, as a deal will only be passed to the bank if all the steps are passed,” he said. Cote said third-party collaboration of data and aggregating portfolios against one can provide more comfortability. One problem with performance data is the obsession with RevPAR. “All is more advanced in the rooms product. There is a need to be more clever in the rest of the building,” Aprirose’s Kapadia said. Cote said taking meaningful information from net RevPAR, with distribution costs subtracted from rooms revenue, is difficult in a country such as the United Kingdom, where “about 70% of revenue comes in from rooms … and there is no definite statement as to what net RevPAR is.” The meaning of net RevPAR also needs standardization, Cote said. “You have to have a benchmark, which is why it is currently more blurry due to the variation of definitions. Someone has to take a stance. After all, someone must have come up with RevPAR? I do not know who or when that happened?” Kapadia said. Turner added the industry has to continue to be supportive of the data and the terminology of it, and that thinking has to be adopted by universities and hotel schools. Walker said he does not believe the franchise model will change quickly because it remains very focused on RevPAR. Paralysis Sources also said there is a danger of “analysis paralysis” due to there being perhaps too many tools to look at. “Who is to say we should at any time be happy with our current state? And then how do we turn it into an actionable strategy, especially when you have multiple stakeholders to talk to?” Kapadia added. Owners Management Group International’s Turner, who also manages the Laura Ashley hotel and tearoom brand, said metrics on leisure clubs—membership rates, attrition, cost of acquisitions—and F&B remain in their infancy, if they exist at all. He added one shortcoming is that this operational excellence often comes at the expense of creativity and communicating with customers. “A broad view is necessary, on consumer data not historical,” Turner said. “I know what is good or not good for my business. It’s easy to look at the stats and the relevant costs, but it is not good enough only to look at the lowest costs. (One also must look at) the quality and what is right for the guest,” No. 15 Great Pulteney’s Walker said.

Create: Dec 3, 2019 Edit: Dec 3, 2019 International News